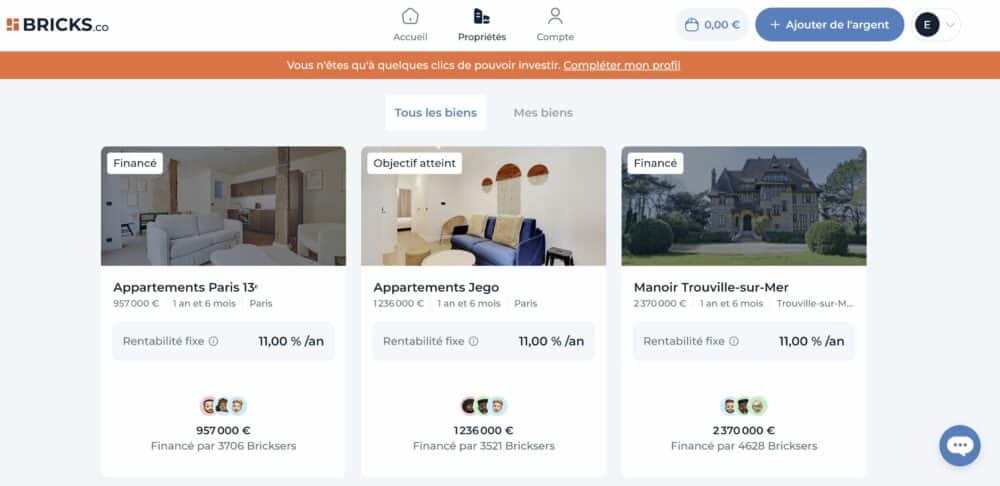

Launched in 2021, the crowdfunding investment platform Bricks has been a financial foundation for project promotors in search of investors, creating a new avenue for architecture professionals.

As anticipation builds for the 2024 Olympic Games, Paris is experiencing a surge in short-term rental activity, reshaping real estate financing. Crowdfunding for rental properties, particularly tailored for travelers, is booming. Bricks, a leading crowdfunding platform, reports a 20% increase in funding for short-term rental properties. CEO Cédric O’Neil attributes this to optimistic financial forecasts tied to the Olympics.

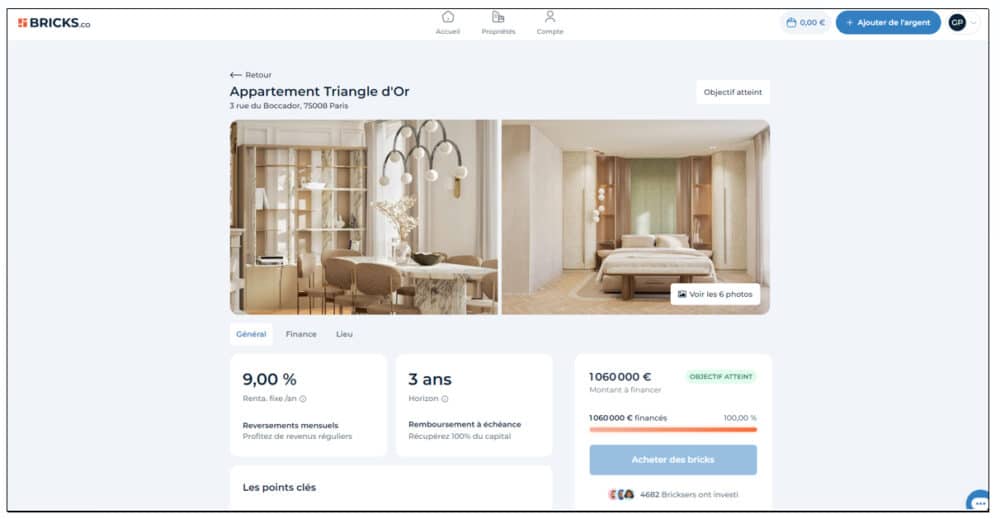

In Paris’s 8th arrondissement, “Le Triangle d’Or,” a standout project, has attracted attention. Led by Clark and Nelson HASSAN, it raised an impressive €1,060,000 from over 4,682 investors in days. The 70m² apartment offers a luxurious stay for up to six guests, rivaling high-end hotels. Positioned between avenues Montaigne and George V, it provides both access to Parisian life and tranquility.

Clark Hassan highlights the project’s investment strategy, projecting an annual gross rental income of €176,573 and a net annual return of 13.96%. We discuss Le Triangle d’Or’s role in Parisian short-term rentals as well as its implications for architecture and design professionals with Clark Hassan and Cédric O’Neill.

ArchiExpo e-Magazine: Can you tell us about Bricks?

Cédric O’Neil: I launched Bricks in April 2021 because I saw that banks weren’t necessarily supporting project holders and companies that wanted to expand their real estate investment projects. And yet, there were great entrepreneurs with great projects, especially in the short-term rental sector. And that’s what speaks the most to investors. We’ve gathered a community of over 300,000 people who can lend money to project holders starting from €10. The Bricks team selects projects they find credible and assists them in structuring the dossier. We’ll publish them on the platform and individuals can invest €10, €1,000, €5,000, whatever amount they want.

ArchiExpo e-Magazine: How do you select the projects you feature on your platform?

Cédric O’Neil: We have a system similar to an investment fund. My goal is to ensure that the individual who lends money to a project holder can be sure to recover it. We’re going to look at the value of the real estate purchased by the project holder. If I lend 1 million euros, I want to make sure that the apartment, the building, the real estate has a value of at least 1 million euros, or even higher. Higher, that reassures us. We try to apprehend, to anticipate the project holder’s default.

In the worst-case scenario, what happens? If I am not reimbursed, how can I secure the investors? How can I recover the real estate to resell it and recover the money? We look at the value of the project and at the coherence of the business model that will be carried out by the project holder. Is the business model proposed by the project holder viable? Does it allow to pay the interest that is paid every month to the investors?

We are here to secure, and therefore we are capable of intervening. For example, when Clark proposes a property for financing, I will validate that the projected revenues from Clark’s operation of his apartment are consistent with the repayment they have requested. I need to have revenues that are already higher than the interest charges.

ArchiExpo e-Magazine: Clark, how many times have you used Bricks to finance your real estate projects?

Clark Hassan: This is the third project I’ve done with Bricks. It’s a very good alternative for the simple and only reason that Bricks will look at the project and move much faster than a bank today where banks are closed with slightly higher rates. Bricks will delve into the project, unlike a bank that has to fit into certain boxes that are not always very logical. Also, for 2 or 3 years, depending on the time we finance the product, we’ll be able to generate income because we only pay the interest. And in 3 years, once we have a bank to finance the property for real, it’s much simpler because the property has generated revenue and we’re not on a business model or a business plan where it’s all perspectives. Here, it’s figures, real revenue. I usually take 3 or 4 years with Bricks, and that makes it much easier for the bank to grant a loan later on.

ArchiExpo e-Magazine: Can you tell us more about Triangle d’Or and your work in real estate?

Clark Hassan: I signed this apartment in September. It took some time to set up because it involves significant amounts, and Bricks also intervenes in terms of security for its clients. I’ve been in real estate for 4 years now, and we have about fifteen properties in our family SCI with my brother. We have about fifteen properties all over France, but mainly in places that are quite renowned for tourism like Saint-Tropez and Cannes. And we’re also starting to invest a little abroad, like in Cannes and also in Greece.

ArchiExpo e-Magazine: Did you work with an architect on the Triangle d’Or apartment? Is it finished?

Clark Hassan: We have a team that remains the same on all our projects; however, for this one, we chose another architect who is much more renowned because it’s an apartment that is adjacent to Avenue Montaigne, which is the most expensive avenue in Paris. We managed to obtain authorization to start the work before the signing. It’s supposed to be online by the first week of April, between the 7th and the 10th of April at the latest.

For architecture professionals, there’s a real market for short-term apartments. It’s something that works very well. There’s a lot of research to be done because it’s not just about the client’s desire, but rather about understanding the desires of a tourist when they come to Paris. It has to be Parisian, it has to have a touch of France. Unlike when you design an apartment or a house in Greece, it has to have the touch of the country. And that’s what we try to do when we create apartments in Paris.

You need moldings, you need parquet flooring, you need furniture that matches the city. And it’s a whole other profession. And not just any architect can do that kind of work. We see that there’s a huge business developing around this. Especially since people who create an apartment for their main residence, that’s good. But you’ll have the client once. On the other hand, when you find a project developer like me who buys between 5 and 6 apartments per year, you have recurring clients. It’s a very promising market for architects and designers.

ArchiExpo e-Magazine: Short-term real estate joins the concept of Airbnb, though, right, and the legislation that’s currently being implemented to reduce the explosion of decline in lodging for citizens?

Cédric O’Neil: Yes, indeed, it’s very positive that these regulations are developing in cities. They aim to prevent residential apartments, which are intended for residential purposes, from becoming Airbnbs or being rented out for very short periods. When you have a residential property, you can rent it out for a maximum of 120 nights per year in Paris. All the projects we finance are commercial premises: offices or commercial spaces that have been transformed into Airbnbs. Their designation, the license, is a commercial license and not a residential one. When you have a commercial license, you can rent out on Airbnb for 365 days a year because it’s commercial. Therefore, all the apartments, for example, Clark’s that we financed, and other project owners have ensured that they are not residential but either offices or commercial spaces.